Acumen Group Real Estate answering questions from Buyers and Sellers at the Rhode Island Home Show. It was a huge success.

https://www.fdic.gov/consumers/loans/prevention/rescue/images/rescue.pdf

Acumen Group fighting against a second power plant in Burrillville, R.I.

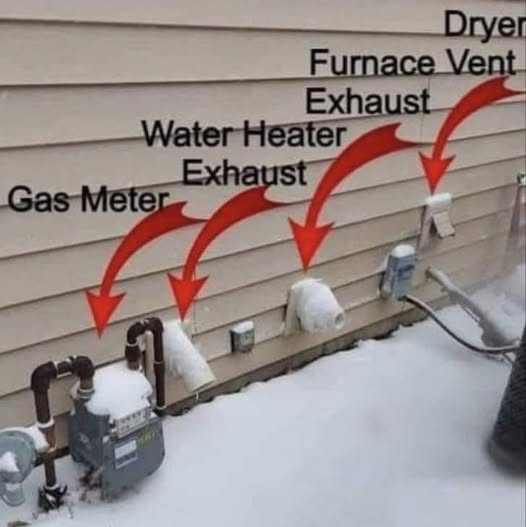

With the winter weather here, it is vital to keep your furnace vents clear of snow during snowstorms, as a blocked vent can lead to a dangerous buildup of carbon monoxide inside your home due to the inability of exhaust gases to properly escape.

𝐊𝐞𝐲 𝐩𝐨𝐢𝐧𝐭𝐬 𝐭𝐨 𝐫𝐞𝐦𝐞𝐦𝐛𝐞𝐫:

𝐒𝐚𝐟𝐞𝐭𝐲 𝐡𝐚𝐳𝐚𝐫𝐝: A blocked furnace vent can prevent your furnace from functioning properly, potentially causing carbon monoxide to accumulate in your home, which is colorless, odorless, and can be deadly.

𝐑𝐞𝐠𝐮𝐥𝐚𝐫 𝐜𝐡𝐞𝐜𝐤𝐬: During snowy weather, regularly check your outdoor furnace vents for snow buildup and clear them as needed.

𝐇𝐨𝐰 𝐭𝐨 𝐜𝐥𝐞𝐚𝐫: Simply remove snow from around the vent using a shovel or broom.

𝐁𝐞 𝐚𝐰𝐚𝐫𝐞 𝐨𝐟 𝐝𝐫𝐢𝐟𝐭𝐢𝐧𝐠 𝐬𝐧𝐨𝐰: Even if the initial snowfall isn't heavy, drifting snow can still cover your vents.

𝐂𝐚𝐫𝐛𝐨𝐧 𝐦𝐨𝐧𝐨𝐱𝐢𝐝𝐞 𝐝𝐞𝐭𝐞𝐜𝐭𝐨𝐫𝐬: Ensure you have working carbon monoxide detectors installed in your home.

Stay safe everyone !!

Report Mortgage Fraud

Sellers and buyers often don’t understand what constitutes mortgage fraud. They may simply believe they’ve found a great way around the system. However, as a licensed real estate agent, you should know when something is suspicious, and make certain your clients know as well. If you suspect you may somehow be involved (innocently or not) in mortgage fraud, call your lawyer for advice.

Here are a few places where you can report buyers, sellers, other agents, lenders and second lenders that try to commit mortgage fraud:

Federal Bureau of Investigation

Phone: 1-800-CALLFBI (225-5324)

Online Tips

Housing and Urban Development (HUD) Office of Inspector General Hotline

Phone: (800) 347-3735

Fax: (202) 708-4829

E-mail: hotline@hudoig.gov

Address: HUD OIG Hotline (GFI), 451 7th Street, SW, Washington, DC 20410

PreventLoanScams.org

This organization was launched to serve as a nationwide clearinghouse for loan modification scam information on complaints filed, laws and regulations, and enforcement actions.

Phone: 1-888-995-HOPE

Federal Trade Commission (FTC): Complaint Assistant

Phone (for complaints against companies, organizations, or business practices): (877) FTC-HELP

The Federal Trade Commission collects complaints about fraud, companies, business practices, identity theft, and episodes of violence in the media.

Mortgage fraud is against the law, and is a prosecutable crime. No person, business or lender is too big to take down.

Consumer Guide: The Appraisal Process

If you are financing your home purchase, you will likely be required to get a home appraisal as one of the steps between signing and close. Here’s what you should know:

What is an appraisal?

An appraisal is an opinion on a home’s market value that helps a lender ensure the purchase price is in line with the property value. The process is led by a licensed or certified residential appraiser—an independent third party engaged by the lender to provide a professional judgment on the home’s value. Appraisers do not represent the buyer or seller; their sole duty is to come up with a fair and accurate valuation of the property. While all appraisers follow a set of standards, appraisers who are REALTORS® have the added commitment to uphold the REALTOR® Code of Ethics.

Do I have to get an appraisal?

If you are taking out a mortgage on your new home, your lender will usually require you to get an appraisal to help establish the “loan-to-value (“LTV”) ratio,” or the percentage of the home's price that you'll borrow. Higher LTV ratios are riskier investments for the lender, so generally they look for LTV ratios of 80% or less. If you are paying in cash, an appraisal isn’t required, but it can still be useful to get a third-party opinion to make sure you aren’t overpaying. In certain instances, the requirement for an appraisal may even be waived by either the lender or the buyer to make their offer more attractive to a seller.

What does an appraiser look at?

Different appraisers may take different approaches. By referencing databases such as Multiple Listing Services—online platforms that compile home listings in a given market—appraisers can use recently sold properties that have similar characteristics, called “comparables,” to help come up with a reasonable value for your home. They will also look at the home’s condition, recent renovations or improvements, amenities, location, size, and other characteristics. Whatever method an appraiser uses, it must be independent, un-biased, and backed up by evidence.

Do appraisals take place in person?

An appraisal may include an in-person visit, but it is not always required. In some instances, hybrid and desktop appraisals are used where appraisers collect data remotely and speak with reliable third-party sources familiar with the property and surrounding area, such as current or former agents of the comparables being considered.

Is my agent allowed to communicate with the appraiser?

Yes. Your agents and others involved in the transaction are allowed to communicate with the appraiser and provide property information. It is not only unethical, but it is also unlawful for agents to intimidate, persuade, or bribe an appraiser to influence the valuation, and an appraiser may not disclose confidential information at any time.

What happens if the appraised value is different from the purchase price?

A mismatch between a home’s appraised value and the purchase price can impact how much your lender allows you to borrow for your mortgage. You can negotiate to include an appraisal contingency—a condition that the value and purchase price must align in order for the transaction to continue—in your purchase agreement, but an appraisal contingency is not required.

Will I receive a copy of the appraisal?

Yes. The Federal Equal Credit Opportunity Act requires lenders to automatically send you a free copy of home appraisals and all other written valuations on the property after they are completed. However, if you are granted an appraisal waiver by your lender, your lender is not required to send you a copy of the valuation report.

Can I request that an appraiser correct or update the appraisal?

If you believe the appraiser did not consider important information about the property or available comparables, you can request a reconsideration of value (“ROV”) to ask that the appraiser reevaluate their analysis. Your lender will provide instructions on how to initiate an ROV, and your agent can help you gather the appropriate information to complete the request. If you believe an appraiser has reached an inaccurate or biased decision, you can also file a report with your state and federal regulatory agencies using the Appraisal Subcommittee’s Appraisal Complaint National Hotline, or a local nonprofit fair housing organization (find by ZIP code here). Find support and other resources here.

Practices may vary based on state and local law. Consult your real estate professional and/or consult an attorney for details about state law where you are purchasing a home. Please visit facts.realtor for more information and resources.

Consumer Guide: Steps Between Signing and Closing on a Home

Once you sign a purchase agreement on your new home, there are still several steps to complete before you can finalize—or “close”—the transaction. While the process differs in each state, here are the basics of what you can expect during the period between signing and closing:

What happens after I sign a purchase agreement?

Once you have signed a purchase agreement, you will enter “escrow,” an arrangement that protects both buyers and sellers during real estate transactions. Escrow means that a third party controls payments between you and the seller in a separate account and will only release the funds once both you and the seller meet the terms of your agreement. An agent who is a REALTOR® can help you navigate this process.

What goes into an escrow account?

Typically, a buyer puts money into the account to show they intend to close on the home, called “earnest money.” This may be a percentage of your purchase price or a set amount. The seller’s property documents will also be held in escrow by a designated person, such as an attorney or another agent. Once you close on the home, your money will typically be applied towards your down payment and other closing costs.

What do I need to do before I can close?

If you are paying for your home over time, you will first and foremost need an approved mortgage loan before closing. Mortgage lenders typically require certain tasks be completed before close, such as a home appraisal and a title search which verifies the seller owns the home. Lenders may also require that you purchase homeowners or other types of insurance. Homeowners insurance is important because it will cover you for unexpected losses at your home, which can help you repair or rebuild after damage, replace your belongings, and/or cover medical expenses if someone is injured on your property. You may also want to consider other types of insurance, such as mortgage, flood, or title insurance, depending on your circumstances. If your down payment is less than 20%, you may be required to have mortgage insurance as well.

What is an appraisal?

A home appraisal is a professional opinion of a home’s value by a licensed or certified residential appraiser that helps the lender ensure the purchase price is in line with the property value. Your purchase agreement might have a “contingency” on an appraisal—a condition that the market value and purchase price must align in order for the transaction to continue. A mismatch between a home’s appraised value and the purchase price could impact how much your lender allows you to borrow for your mortgage. Some lenders also have appraisers verify certain things like chipped paint or hand rails to ensure the home is safe. If you are not using a mortgage and are paying for a home “in cash”—money you currently have available—you still may make your offer contingent on an appraisal or do one independently, but it is not required.

Do I need an inspection?

While not required, some buyers include a home inspection as a contingency in their purchase agreement. An inspection protects you from costly problems you may not have noticed until after moving in. An inspector will look for potential problems throughout the interior and exterior of the home, which could include tests for radon, lead paint and asbestos. Your agent can help you find a trustworthy inspector and determine which type of inspection will work best for you.

How long will all this take, and when can I move in?

These steps may take several weeks or more depending on your situation. Each part of the process operates on its own independent timeline, so the length of the process is influenced by many factors, such as when you schedule home inspections and how long it takes for your mortgage application to be approved.

What happens at close?

You can expect to sign documents, exchange keys, and bring your cash to close—the amount of which can vary depending on your down payment, credits, and other fees for things like the inspection, loan processing, or costs related to purchased insurance policies.

Practices may vary based on state and local law. Consult your real estate professional and/or an attorney for details about state law where you are purchasing a home. Please visit facts.realtor for more information and resources.

The World Is Getting Riskier. Americans Don’t Want to Pay for It.

California is a microcosm of what happens when insurance breaks down: Either households face potential ruin, or the public is handed a financial time bomb.

By

Jan. 19, 2025 5:30 am ET

Gift unlocked article

Listen

(8 min)

An aerial view of homes burned in the Palisade wildfire in Los Angeles earlier this month. Photo: Josh Edelson/Agence France-Presse/Getty Images

Insurance is one of finance’s great gifts to mankind. Through the statistical magic of risk pooling, an individual can obtain peace of mind and protection against devastating loss.

This remarkable invention shows signs of breaking down. As risks from illness and old age to natural and financial disaster grow, so does Americans’ resistance to paying to insure against them.

The latest example is California. Earlier this month, JPMorgan estimated the fires around Los Angeles had inflicted $50 billion in losses, of which only $20 billion were insured.

One reason for the gap: State regulators have prevented insurers from charging premiums commensurate with rising property values, construction costs and wildfire risk exacerbated by a warming climate. Many thus stopped renewing policies.

Hundreds of thousands of homeowners shifted to California’s state-run backstop, the Fair Plan, whose exposure has tripled since 2020 to $458 billion. It has only $2.5 billion in reinsurance and $200 million in cash.

If the Fair Plan runs out of money, it can impose an assessment on private insurers to be partly passed on to all policyholders. In other words, the costs of the disaster will be socialized.

A home destroyed by the Eaton fire next to a home that survived it, in Altadena, Calif., last week. Photo: Noah Berger/Associated Press

California is a microcosm of what happens when insurance breaks down: Either households face potential ruin or the public is handed a financial time bomb.

“What we are seeing is a real disconnect,” said Carolyn Kousky, an economist specializing in risk and founder of the nonprofit Insurance For Good. “There are opposing views on insurance: Is it a private market good, or is it social protection, to make sure everyone has the resources to recover from disaster?”

A central feature of insurance is risk pooling: The combined contributions of the community cover the losses incurred by members of the community in a given year.

Another feature of private insurance is actuarial rate-making, that is, calibrating premiums to the customer’s risk. That’s to prevent “adverse selection,” in which only the riskiest people buy insurance, and moral hazard—the tendency to encourage risk by undercharging for it.

But some activities or individuals are so risky they could never obtain, or afford, private insurance. That’s when risk gets socialized. The federal government’s expansion since the 1930s has largely been through the provision of insurance: Social Security, unemployment insurance, health insurance for the elderly and poor, deposit, mortgage, and flood insurance and, after Sept. 11, 2001, terrorism insurance. Not for nothing is the federal government often called an insurance company with an army.

The Luigi Factor

Nowhere are feelings about insurance more conflicted than in health. Americans want neither the rationing that comes with government-run insurance, nor the risk-management that comes with private insurance. This became painfully apparent when the fatal shooting of Brian Thompson, chief executive of UnitedHealthcare, triggered an outpouring of fury not at the suspected killer, Luigi Mangione, but at insurers for limiting benefits, such as by requiring prior authorization for care.

A demonstrator displayed a placard outside New York Supreme Court, where Luigi Mangione was being arraigned in the fatal shooting of UnitedHealthcare CEO Brian Thompson last month. Photo: jeenah moon/Reuters

In fact, long before that shooting, the Affordable Care Act had constrained insurers’ ability to base premiums on risk, by prohibiting them from charging more to people with pre-existing conditions or denying coverage altogether.

The ACA also stipulated that insurers spend at least 80% to 85% (depending on the plan) of premiums on benefits. So while denials, deductibles and copays may, at the margin, affect profits, ultimately they serve to control premiums.

In finance, where risk supposedly goes hand in hand with reward, losses have been repeatedly socialized, most notably when major financial institutions were bailed out in 2008.

Advertisement

Deposit insurance, on paper, is capped at $250,000. Depositors with more are supposed to be careful where they keep their money. But in 2023, the Federal Deposit Insurance Corp. bailed out all the uninsured depositors of Silicon Valley Bank and Signature Bank. The costs are being socialized via a special assessment on other banks’ uninsured deposits.

SHARE YOUR THOUGHTS

What is the best way to reasonably protect Americans from risk? Join the conversation below.

What financial disaster was to the last era, natural disaster may be to the next. In a World Economic Forum survey, business, government and other leaders ranked extreme weather the most severe of 33 risks facing the world in the next 10 years. Major disasters pose a particular problem for insurers because claims occur all at once instead of randomly.

And as with financial disasters, the cost of natural disasters is being socialized. Numerous states have backstops for homeowners unable to get private insurance, and all struggle to charge premiums that reflect actual risk.

In a 2023 study for California insurers, Nancy Watkins, an actuary with Milliman, an insurance consultancy, found that plans in California, Washington, Louisiana and Florida, which had doubled in size between 2017 and 2022, all incurred more in losses and expense than they took in through premiums.

In Florida, frequent storms, flood-plain development, inflation, fraud and litigation have pushed home-insurance premiums to the highest in the country. Yet insurers were “discouraged from large rate hikes by public hearings, documentation requirements, and their own customers and agents,” Kousky and a co-author wrote last year. In years past, some insurers pulled back, or became insolvent.

Hurricanes and other factors have pushed Florida’s insurance premiums to the highest in the country. Photo: Miguel J. Rodriguez carrillo/Agence France-Presse/Getty Images

As in California, Florida homeowners flocked to the government backstop, Citizens Property Insurance. Like California, Florida has taken steps to make its insurance market financially viable. It has cracked down on litigation and allowed Citizens to raise premiums. Nonetheless, Citizens last year said premiums are 22% below the actuarially sound level.

Kousky said in the event of a series of major storms, Florida’s three insurance backstops—Citizens; a reinsurance fund; and guaranty program for insolvent insurers—could struggle to borrow enough to pay claims, triggering demands for a state or federal rescue.

Taxpayers nationwide are also on the hook. Since 2020, Congress has appropriated an average of $46 billion per year for disaster relief, triple the average of the prior decade (in constant 2023 dollars). Late last year, Congress rushed through $100 billion in aid for disasters including hurricanes Helene and Milton.

Socializing risk weakens one of the main benefits of insurance: Encouraging the insured to mitigate their risk so as to reduce premiums. Without that price signal, it usually takes direct intervention to modify behavior. After being bailed out in 2008-09, banks have had to submit to far more stringent safety and soundness rules.

The same may be true of natural disasters. If the risk is to be socialized, society has a right to demand the insured mitigate their risk, such as making homes more flood, wind and fire proof or staying out of disaster-prone areas entirely.

“It involves alignment of ordinances, building codes, enforcement, inspection, and finding resources for…communities and homeowners who really can’t afford” such measures, Watkins said. “All that is politically difficult. But it’s becoming increasingly obvious the old strategy, of denying the risk, has failed.”

New State-Wide Short-Term Rental Registration Requirements Effective January 30, 2025

Published Sunday, October 20, 2024

Rental properties that are rented for 30 nights or fewer at a time on a hosting platform, which includes real estate brokerage sites, must be registered with the Rhode Island Department of Business Regulation (DBR). A new law S2410Aaa.pdf (rilegislature.gov) will require the following changes to the registration to take effect on January 30, 2025:

▪The property must be registered before it is listed on a hosting platform. The hosting platform remove the listing from its web site within 14 days after notification from DBR if the owner fails to renew the registration.

▪Listings of short-term rental properties on hosting platforms must include the registration number issued by the Department and the expiration date of the registration.

▪The registration must state whether the rental unit is in a single-family home, multi-unit, apartment, condominium, or timeshare.

▪The registration will expire after one year instead of two years.

▪The registration fee will change to $25 per year instead of $50 every two years.

DBR is revising its regulations to comply with the new law. Short-Term Rental Property Registration, 230-RICR-30-20-4.https://rules.sos.ri.gov/Promulgations/part/230-30-20-4.

R.I. Home Prices Still Climbing

Published Thursday, October 17, 2024 9:00 am

by RI REALTORS

Warwick, R.I. – October 17, 2024 – The median price of single-family homes sold in September climbed 6.6% year-over-year, continuing a trend in Rhode Island that began in February 2017. The Rhode Island Association of Realtors reported sales statistics today showing that last month’s median sale price of $485,000 was $30,000 higher than September 2023.

Sales activity has shown signs of slowing down and though that would typically put some downward pressure on prices, they are expected to remain elevated due to the pent-up demand caused by the housing shortage. Inventory continues to creep upward - now at a 2.4-month supply - an improvement from a year ago but still critically low. Closed sales fell by three percent and pending sales, the most common indicator of future sales, also dropped by 2.2%.

“Each month since January 2022, pending sales have fallen compared to the previous year, a sign that housing affordability is not improving in Rhode Island. The median sales price of single-family homes has risen year-over-year every month since January 2017. We desperately need to build more housing,” said Sally Hersey, President of the Rhode Island Association of Realtors.

The condominium market followed the same trends with September’s median sales price up 12.5%, reaching a record high at $427,450. The number of closed sales was down 5.3% from a year earlier.

The slowdown in sales is expected to continue in the months ahead as the number of sales put under contract but not closed by the end of September dropped by 8.4%. Falling sales have helped build inventory. The number of condominiums listed for sale increased 31% year-over-year.

The median sales price of multifamily homes skyrocketed to a record $595,000, 24.6% higher than that of September 2023. Closed sales fell by 12.6% from the previous year, though pending sales showed improvement in activity with an increase of four percent. The number of multifamily homes on the market rose 7.4% from September 2023.

“We haven’t yet seen much of an effect from the Federal Reserve’s September rate cut on Rhode Island’s housing market. Our main problem continues to be supply. The Realtor Association is committed to supporting all viable legislative initiatives that can help in that regard in the 2025 legislative session,” said Hersey.

Sales data is pulled from State-Wide Multiple Listing Service, a subsidiary of the Rhode Island Association of Realtors. The transaction system includes information about all Realtor-assisted sales.

RI BUSINESS

Rhode Islander housing prices continue to soar overall, though condo prices drop slightly

The median price for a single-family home shot up 11.5 percent in October, according to The Rhode Island Association of Realtors

By Omar Mohammed Globe Staff

The newly renovated three-family home at 294 Rhode Island Ave. in Woonsocket, R.I.Carlos Muñoz

PROVIDENCE – First-time homebuyers face many hurdles when it comes to purchasing a home in Rhode Island, including a lack of available, affordable properties and high mortgage rates and housing prices.

But while the the median price for a single-home property shot up 11.5 percent in October from a year ago to $485,000, according to The Rhode Island Association of Realtors, the number of sales and pending transactions in the Ocean State also rose during that time.

Overall, the number of closed deals rose more than 5 percent, and pending transactions increased 7 percent, the organization announced Thursday. But supply continues to be a problem: In October, homes available for sale rose nearly 5 percent — to about two months’ worth of supply, which is way below the five to six month cushion that real estate experts deem healthy for the market.

The multifamily segment of the market also saw prices soaring. The median price went up from $482,500 to $560,000 last month compared to October 2023, realtors said, driving the number of sales up more than 17 percent.

A weekday briefing from veteran Rhode Island reporters, focused on the things that matter most in the Ocean State.

An analysis from the National Association of Realtors suggests that interest in multigenerational homes has increased overall, as young buyers struggle to purchase homes by themselves. The average first-time buyer is 38-years old and earns about $97,000 per year, up from $71,000 two years ago.

“We’re seeing homeowners who are tapping into their equity and 401k and competing for properties with first-time home buyers without those luxuries. Many are cash buyers who are downsizing or buying a second home,” Chris Whitten, president of the Rhode Island Association, said in a statement. “It’s tough for younger buyers to compete with that.”

While programs that assist with down payments have been helpful, the lack of enough affordable homes in the Rhode Island market is proving prohibitive to all homebuyers.

Meanwhile, interest rates for mortgages are still elevated. The 30-year fixed mortgage rate edged closer to the 7 percent mark, according to lender Freddie Mac, the highest it has been since the summer.

“Higher prices and interest rates are still the biggest pain points preventing our younger generations from starting to build equity through home ownership,” added Whitten.

Advertisement

One silver lining can be found in the condo market.

The median price for a condo in Rhode Island declined from $380,000 to $355,000, fueling a jump of more than 15 percent in sales. But even in that segment, supply remains a challenge.

“At the current rate of sales, all the condominiums available for sale in Rhode Island would be sold in just over two months if no new listings went on the market,” Whitten said.

Scaling construction in the condo market could help, he added, something that the Realtors Association is lobbying for with policymakers.

“More development is the key to help get younger generations into home ownership,” Whitten said.

Follow Omar Mohammed on Bluesky: @shurufu.bsky.social

Some of our past and current ads....

Some Other Stuff:

“It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither know victory nor defeat.”

― Theodore Roosevelt

The Man in the Arena

A goal without a timeline is simply a dream.

The problem is....We look for someone to grow old together, While the secret is to find someone to stay a child with! What does Love mean to 4-8 year old kids?

Slow down for a few minutes to read this...A group of professional people posed this question to a group of 4 to 8 year-olds, 'What does love mean?' The answers they got were broader, deeper, and more profound than anyone could have ever imagined! 'When my grandmother got arthritis, she couldn't bend over and paint her toenails anymore... So my grandfather does it for her all the time, even when his hands got arthritis too. That's love.' Rebecca - age 8 'When someone loves you, the way they say your name is different. You just know that your name is safe in their mouth.' Billy - age 4 'Love is when a girl puts on perfume and a boy puts on shaving cologne and they go out and smell each other.' Karl - age 5 'Love is when you go out to eat and give somebody most of your French fries without making them give you any of theirs.' Chrissy - age 6 'Love is what makes you smile when you're tired.' Terri - age 4 'Love is when my mommy makes coffee for my daddy and she takes a sip before giving it to him, to make sure the taste is OK.' Danny - age 8

'Love is what's in the room with you at Christmas if you stop opening presents and just listen.' Bobby - age 7 (Wow!) 'If you want to learn to love better, you should start with a friend who you hate.' Nikka - age 6 (we need a few million more Nikka's on this planet) 'Love is when you tell a guy you like his shirt, then he wears it every day.' Noelle - age 7 'Love is like a little old woman and a little old man who are still friends even after they know each other so well.' Tommy - age 6 'During my piano recital, I was on a stage and I was scared. I looked at all the people watching me and saw my daddy waving and smiling. He was the only one doing that. I wasn't scared anymore.' Cindy - age 8 'My mommy loves me more than anybody. You don't see anyone else kissing me to sleep at night.' Clare - age 6 'Love is when Mommy gives Daddy the best piece of chicken.' Elaine - age 5 'Love is when Mommy sees Daddy smelly and sweaty and still says he is handsomer than Robert Redford.' Chris - age 7 'Love is when your puppy licks your face even after you left him alone all day.' Mary Ann - age 4 'I know my older sister loves me because she gives me all her old clothes and has to go out and buy new ones.' Lauren - age 4 'When you love somebody, your eyelashes go up and down and little stars come out of you.' (what an image!) Karen - age 7 'Love is when Mommy sees Daddy on the toilet and she doesn't think it's gross...' Mark - age 6 'You really shouldn't say 'I love you' unless you mean it. But if you mean it, you should say it a lot. People forget.' Jessica - age 8

And the final one: The winner was a four year old child whose next door neighbor was an elderly gentleman who had recently lost his wife. Upon seeing the man cry, the little boy went into the old gentleman's yard, climbed onto his lap, and just sat there. When his mother asked what he had said to the neighbor, the little boy said, 'Nothing, I just helped him cry.'

Go be a child again today!

© 2024. All rights reserved.